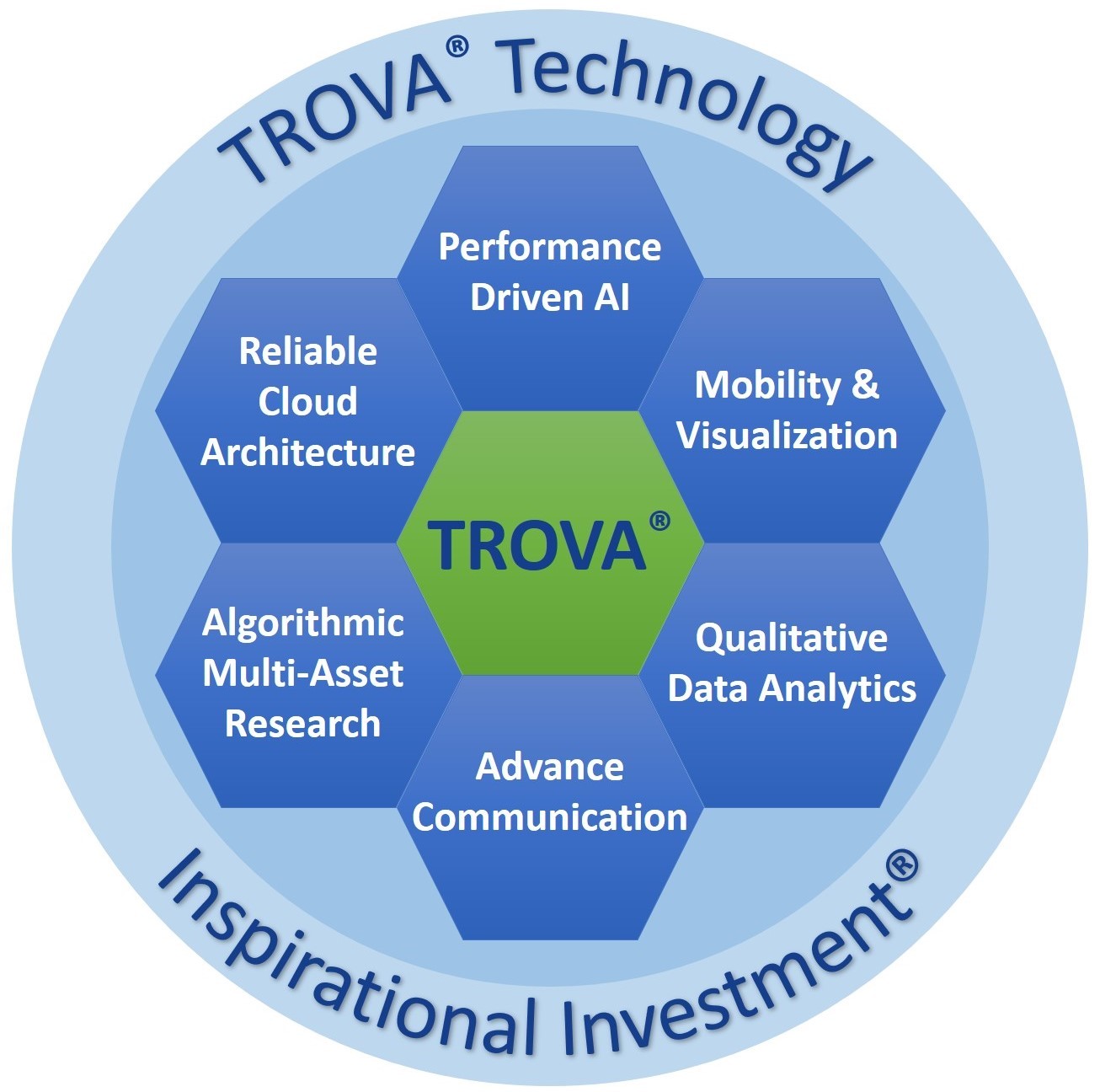

Our technology discovers datasets using artificial intelligence and machine learning to help our customers make better investment decisions for achieving the highest possible ROI.

TROVA: "High Performance Investment Research Data Platform"

Powered by Artificial Intelligence

Making successful investments in today’s world is both an art and a science.

Better choices can lead to better return on investment (ROI), but finding the right investments is both complex and time consuming. The NetFin's investment data platform is built upon the principle of discovering smart datasets using artificial intelligence and machine learning that help make well-informed investment decisions for the highest possible return.

These cloud-based services optimize information aggregation and data analytics to identify a select set of companies with the highest potential return on investment. Then investors can make their own investment decisions, choosing the ones with which they are most comfortable.

Advantages

- Getting better data based on well-qualified learning algorithms

- Up-to-date performance reports

- Data provided is both time and cost optimal

- Better data provides investor flexibility in decision making

- Personalized service offerings based on investor needs and expectations

I found my experience with NetworkFinancials Inc. to be very enriching. There is no pressure to invest, and the flexibility is very encouraging.

Beating S&P 500 ETF by a decent margin is a huge achievement. Service offerings are much more rewarding than traditional players.

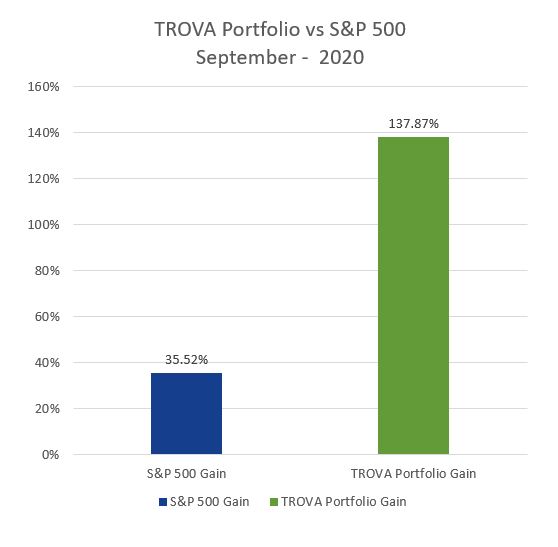

Snapshot of Latest TROVA Powered Portfolio Performance:

World is witnessing unprecedented impact across various industries because of covid-19. To give a glimpse of the performance edge of our TROVA capabilities during this market volatility, we did a comparison analysis of performance of a TROVA powered portfolio against S&P 500 (SPY ETF).

Result clearly depicts TROVA powered portfolio outperforming S&P 500 by a huge margin of 102.34%.

Measurement is done over a random interval spanning March 2020 to August 2020.

This result proves again of TROVA Investment Data Platform's strength and our quest for innovating to bring the best investment opportunities to our clients across various asset classes.

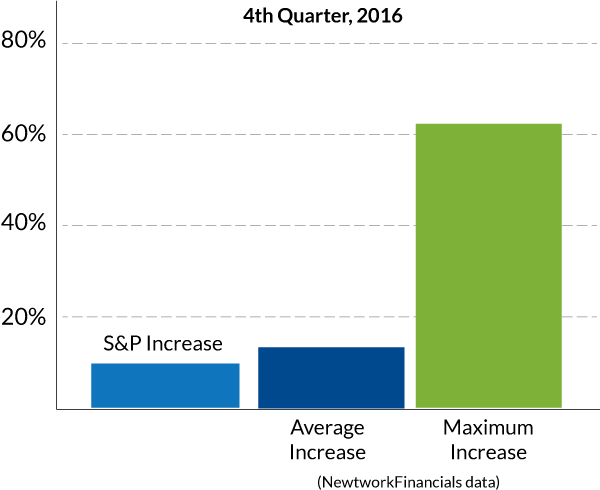

Our NFSelect Service Beats S&P 500 twice in a row!!

Performance of datasets selected by our NFselect service during Q1, 2017 were measured between Jan 1, 2017 and May 31, 2017. From the perspective of maximum increase, all the premium plans maintained great margins. On average two of the premium plans beat S&P 500 significantly and the third one was on par with S&P 500.

To the right is a snapshot of the performance of datasets selected by NFselect during Q4, 2016 as compared to the S&P 500 ETF (SPY). Datasets considered in this performance analysis belong to the premium membership Silver, Gold, and Platinum plans.

Measurement was done over a random interval spanning Oct 12, 2016 to February 14, 2017.

Trovespace: World's first AI-enabled momentum scoring engine

For active traders it is challenging to find best choice during market volatility be it a bull market or bear market.If value proposition can be established to extract gain in short term as well building a better long term portfolio it will be close to ideal solution. Trovespace is designed with proprietary AI technique to come up with a solution which helps existing NFselect customers further as a complementary solution as well as active traders to capitalize the accuracy of relative momentum strength of companies from ROI perspective using our industry leading unbiased qualitative data analytics.

Sample snapshot shown here depicts the relative momentum strength of 5 companies discovered through Trovespace service momentum feature.

Start exploring Trovespace today. Click Here to signup now.

Sample TroveSpace Datasets & Visuals.

Sample TroveSpace Datasets & Visuals.